Field Note #001: The Structural Reset

The anchors of the old world are cut

01 // THE SIGNAL

You are successful on paper. By the metrics of the Old Map, you have won. But you do not feel insulated. You feel exposed.

The old rules still look intact, but they no longer protect you the way they used to. That is not irrational fear. It is pattern recognition. You are sensing a structural shift: the mechanism that guaranteed stability has broken.

To understand why, we have to look at the engine room.

The Lost Anchor

Western financial systems were originally designed with physical brakes. Constraints acted as limits on power. The primary brake was physics.

Money was anchored to a physical standard (gold). This meant governments faced hard limits: credit expansion required collateral, and ambition was bounded by what they actually held in the vault.

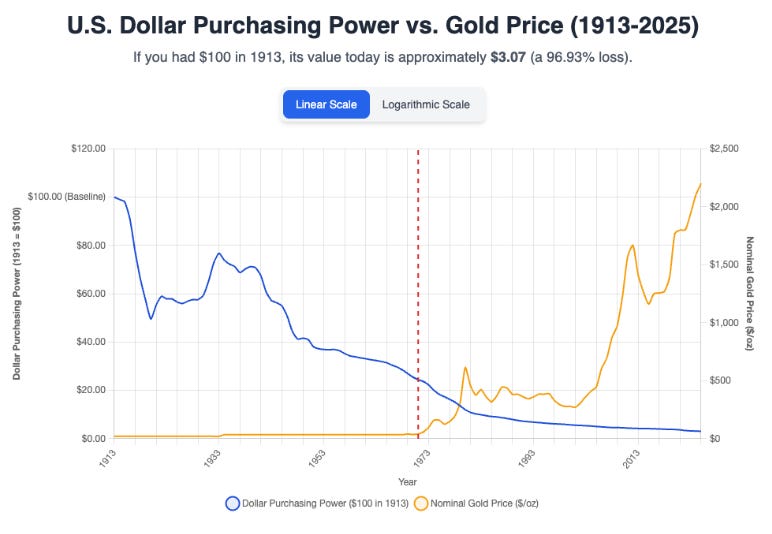

In 1971, that wire was cut.

The architects replaced the wooden ruler (hard money) with a rubber band (fiat currency). Measurement became elastic.

This matters because when the “measuring stick” can stretch, prices and assets can rise numerically even if real productivity doesn’t. The constraint disappeared. The incentives remained.

02 // THE PIVOT

This was not a single accident. It was a staged transfer of control from the physical world to the policy world.

1913: The Federal Reserve separates the printer from the voter. Control over the money supply is removed from the market and centralized in an administrative agency.

1944: Bretton Woods anchors the global reserve to gold. This enforces a mathematical limit on government spending.

1971: The gold anchor is cut. The link to physical reality is severed, turning money from stored work (finite) into a tool of policy (infinite).

For fifty years, the system ran hot. Asset prices rose not because the things we bought became more valuable, but because the currency used to buy them became weaker.

We were told this was growth. In reality, it was debasement.

03 // THE CURRENT STATE

We have entered a transition phase. The math is broken.

The debt cannot be paid back because, in a fiat system, the debt is the money. Most money is created when banks issue loans or governments issue bonds. Therefore, “paying back all the debt” would shrink the money supply and crash the economy.

Because full repayment is impossible, the only viable path for the State is dilution.

Dilution means printing more money to make the debt cheaper to service. Purchasing power is harvested from savers to subsidize debtors. You pay for the bailout not through direct taxes, but through the slow erosion of your savings.

The Next Phase: Containment

Dilution creates a problem for the State: capital flight. When people realize their currency is weakening, they try to move their wealth elsewhere.

To stop this leakage, the architecture of money is shifting. We are moving from Money as a Product (cash you own) to Money as a Service (ledgers you access).

Digital currency systems can carry rules. Instead of money working the same way for everyone, it can be designed to work only in certain situations. These are not hypothetical features. Versions of all three already exist:

Velocity Terms: Interest rates that change based on your behavior (e.g., negative rates that force you to spend rather than save).

Time-Bound Disbursements: Stimulus funds that expire if not used by a certain date.

Restricted Acceptance: Funds that can only be spent on approved categories (like rent or food) and blocked for others.

The goal is not just debasement, but containment. If your strategy relies on blind trust in institutional permission, you are standing on a rug that is being pulled.

04 // THE NEW ARCHITECTURE

The machine cannot be fixed. We can only engineer a better interface with it. This requires a shift in Vector 1: Wealth.

Most modern wealth exists as “Claims”—promises on a piece of paper. A bank deposit is a claim. A stock is a claim. A claim only works as long as the institution honoring it remains solvent and cooperative.

The Rational Architect shifts toward “Assets”—value that exists on its own without requiring a signature to be valid.

Land.

Commodities.

Code.

The principle is simple: Own what exists without requiring a signature.

Forward Protocol

Money is only the first layer. A solvency strategy fails if the operator is physically fragile or digitally exposed.

Future coordinates:

Field note #003: The Three Zones Theory // Navigating the map.

Field note #004: The Capacity Audit // Hardening the vehicle.

Field note #006: The Sovereign State // Holding the position.

Update the map. The system is rebooting. It is time to find your bearing.

No Noise. No Politics. Just Coordinates.

- AZIMUTH